Employer retention credit calculation

This credit is not to be confused with the tax credit under the Families First Coronavirus Response Act which includes Emergency Family Medical Leave. In 2021 the ERC increased to 70 of up to 10000 in wages paid per employee per quarter for Q1 Q2 and Q3.

Answers To Employee Retention Credit Faqs Lendio

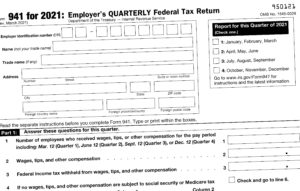

New guidance from the IRS helps employers understand the impact of PPP loan forgiveness and employee tips on calculation of the employee retention credit.

. How do I calculate if an employer is a large or small employer for the Employee Retention Credits. Employer Size A GUIDE TO EMPLOYEE RETENTION CREDITS ERC 4 Key Provisions of the ERC Contd Annual cap of 5000 aggregate 10000 in qualified wages x 50. Accounting for the Employee Retention Credit.

The Revolving Loan Fund component provides funding or capital to economic development. Of Notice 2021-20 provides that under section 2301 eligible employers are entitled to claim the employee retention credit against the employers share of social security tax after these taxes are reduced by any credits claimed under sections 3111e and f sections 7001 and 7003 of the Families First Coronavirus Response Act. As per the provisions of the Income Tax Act 1961 any arrears of salary paid or allowed to an employee in the previous year by or on behalf of the employer or a former employer if not charged to income tax for any previous year are chargeable to income tax during the given year under the head Salaries.

How to Determine Your ERC Amount. Your Employee Retention Credit Calculator for 2020 and 2021. The 2020 ERC Program is a refundable tax credit of 50 of up to 10000 in wages paid per employee from 31220-123120 by an eligible employer.

Its a credit against the employers share of FICA 62 owed on your quarterly payroll. 35400 -Rs112400 6th CPC Grade Pay Rs. Information updated because the Coronavirus Job Retention Scheme ended on 30 September 2021.

In this webinar Beth and Holly review the federal relief options available for small businesses. 2021 which means that in tax year 2021 the maximum tax credit available to an employer per employee is 21000. Plus an additional 375 bonus OR 2 raise from your employer and a commitment to remain employed at your program for 1 year.

That is a potential of up to 5000 per employee. Learn more about the Employee Retention Credit ERC as we answer the most frequently asked questions FAQs about this payroll tax credit. The Employee Retention Credit ERC is also available to businesses that opened after February 15 2020.

Section 2301c2 of the CARES Act defines the term eligible employer Section 2301c2Ai of the CARES Act as amended by section 207a2 of the Relief Act provides that in order to be an eligible employer an employer must have been carrying. In 2021 the ERC increased to 7000 paid per employee per quarter for Q1 Q2 and Q3. 15 October 2021.

The payroll tax credit is in addition to the tax credit for Emergency Family Medical Leave. For all quarters of 2021 the employee retention credit can be claimed against applicable employment taxes. Is a refundable tax credit of 50 of up to 10000 in wages paid per employee from 31220-123120 by an eligible employer.

That is a potential of up to 5000 per employee. Annual Cost is based on taking 6 credit hours per semester for 3 academic semestersyear This calculation does not include college and course fees outside of tuitioncredit hour or textbook costs. 15 October 2021.

The 2020 and 2021 ERCs act as fully refundable credits against the employer portion of Social Security taxes based on the amount of qualified wages that an eligible employer has incurred. The Employee Retention Credit ERC under the CARES Act encourages businesses to keep employees on their payroll. For the ERC they discussed eligibility criteria and credit calculation in addition to how one claims the ERC.

Information updated because the Coronavirus Job Retention Scheme ended on 30 September 2021. The Tax Credit Compliance Procedures Manual was designed to give property owners and managers step-by step instructions on how to fulfill compliance requirements if Commission-issued low-income housing tax credits were used to finance a property. Scroll down to the Employee Retention Credit Calculation section and start entering qualified wages and health.

One method requires that an employer experienced a significant decline in gross receipts between the quarter in which eligibility is sought and the same quarter of 2019. According to the IRS the refundable tax credit is 50 or 70 for wages paid during the first 3 quarters of 2021 of up to 10000 in wages paid by an eligible employer whose business has been financially impacted by COVID-19. Overview The Pennsylvania State Small Business Credit Initiative PA-SSBCI provides funding to economic development partners for the implementation and administration of capital programs to support small businesses through loans and equity investments.

For the 2020 ERC an employer with 100 or fewer average full-time employees as measured in 2019 is. Beginning January 1 2021 the cap is increased to 7000 per employee per quarter The 2021 credit is available even if the employer received the 5000 maximum credit for wages. Information updated because the last claim date for September has passed.

On August 4 2021 the Internal Revenue Service IRS released Notice 2021-49 which provided additional guidance and clarification for the Employee Retention Credit ERC for quarters 3 and 4 of 2021. While some turnover is inevitable building a retention strategy to prevent as much voluntary turnover as possible can save an organization a lot of time and money. Here are answers to help organizations that claim the credit.

Webinar Employee Retention Tax Credit Essential with Jamie Trull. Employer is an eligible employer for purposes of the employee retention credit for 2020. Here is the Total Minimum Monthly Salary Calculation for 7th Pay Matrix Level 6 Rs.

4200- Calculation of Minimum Gross Salary for Pay Level 6 Level and GP. Information updated because the last claim date for September has passed. A retention strategy is a plan that organizations create and use to reduce employee turnover prevent attrition increase retention and foster employee engagement.

In 2020 a credit is available up to 5000 per employee from 31220-123120 by an eligible employer. The ERTC program is a refundable tax credit for business owners in 2020 and 2021. Reporting Records Retention PDF Rev 112014 61 Summary 61 Owner Annual Certifications.

Employee Retention Credit Erc Calculator Gusto

Employee Retention Credit Erc Calculator Gusto

Employee Retention Credit Calculation How To Calculate Recognize

How To Prepare Your Business For Inflation Infographic Business Infographic Business Advice Business Marketing

Http Keysvalueinvesting Com Learn The Easiest Valuation Method For Stocks In Minutes Method Learning Easy

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek

What Are Cvv2 And Cvc2 Numbers Take Care Of Yourself Credit Card Coding

Guest Column Employee Retention Tax Credit Cheat Sheet Repairer Driven Newsrepairer Driven News

Irs Guidance On Employee Retention Credit Doeren Mayhew

Employee Retention Credit Tax Services Cherry Bekaert

The Employee Retention Credit Erc How To Qualify And Calculate The Credit True Partners Consulting

What You Need To Know About The Employee Retention Credit Cherry Bekaert

Kissflow Hr Cloud Allows You To Turn A Paper Based Checklist Into An Onboarding App And Automate Yo Employee Onboarding Onboarding Checklist Onboarding Process

What Is The Non Refundable Portion Of Employee Retention Credit Disasterloanadvisors Com

An Employer S Guide To Claiming The Employee Retention Credit Buchanan Ingersoll Rooney Pc

Did You Miss Out On The Employee Retention Tax Credits

Changes To The Employee Retention Credit Erc